Yearly has its personal dangers, and 2025 isn’t any exception. However earlier than reacting to current market turbulence, let’s step again to know how we received right here and what it means in your investments.

Doom and Gloom Headlines

During the last 10 days, traders have confronted a wave of unsettling information. The College of Michigan Client Sentiment Index dropped to its lowest since November 2023. Warren Buffet’s annual letter revealed that he has elevated his money holdings. U.S. shopper spending declined in January for the primary time since March 2023. The Federal Reserve Financial institution of Atlanta’s GDPNow mannequin initiatives a decline within the first quarter, which, if correct, can be the primary contraction in GDP since 2022. Including to the uncertainty, after a 30-day delay, President Trump introduced that his administration would implement a 25% tariff on imports from Mexico and China beginning March 4, with a further 10% tariff on Chinese language items.

This degree of uncertainty is unsettling for traders, as markets don’t like uncertainty. Consequently, the S&P 500 has declined 6 % in just some weeks, with final 12 months’s top-performing shares main the decline. Whereas these drops influence portfolios, stepping again and placing issues in perspective is vital. Regardless of the unfavourable headlines, the market continues to be solely 6% beneath its all-time excessive and is again at ranges seen in early January of this 12 months.

Pockets of Energy

Regardless of the unfavourable headlines, not all elements of the market are struggling. Whereas expertise and shopper cyclical shares—final 12 months’s large winners—have led the current decline, different sectors are holding up nicely. Client staples, well being care, and monetary providers have had stronger mid-single-digit returns. As measured by the ACWI ex-USA Index, worldwide shares are up 6.3%. As well as, the U.S. Combination Bond Index can be up 2.7% this 12 months. In brief, diversification is proving its worth once more after an extended interval the place it didn’t appear to assist as a lot.

Market Corrections Occur Each Yr

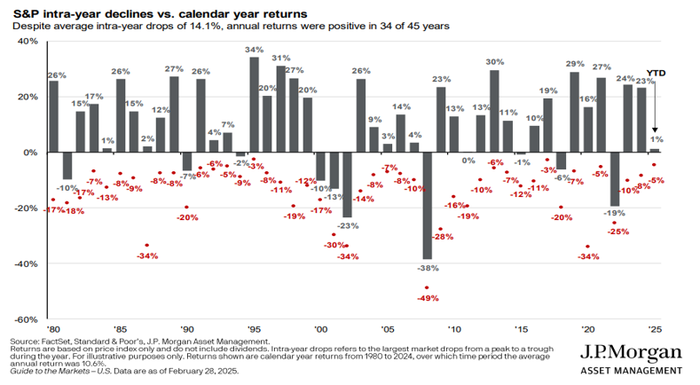

Whereas market pullbacks by no means really feel nice, they do occur often:

Click on right here for a bigger model

Even in robust years, inventory markets are likely to expertise declines within the 5%-10% vary, and these corrections might be wholesome.

historical past supplies some perspective. In 2018, the S&P 500 declined within the first quarter, rallied mid-year, and declined once more within the fourth quarter amid commerce wars and rising rates of interest. Nevertheless, that set the stage for a robust restoration in 2019. Equally, in 2022, the markets fell for 3 consecutive quarters earlier than rallying within the fourth quarter, kicking off two years of robust returns. These examples spotlight that short-term declines don’t essentially point out long-term hassle.

Alternatives in Volatility

Timing the market is extraordinarily troublesome, however intervals of volatility typically create alternatives. Warren Buffett famously suggested traders to “be fearful when others are grasping and grasping when others are fearful.” Whereas this recommendation sounds easy, emotional reactions make it laborious to comply with. Nevertheless, historical past exhibits that the very best occasions to speculate happen when market sentiment is at its worst.

Whereas volatility can proceed and even improve, upcoming financial information might assist reassure traders that the economic system stays stable. Decrease 10-year U.S. Treasury charges might result in decrease mortgage charges, offering extra help.

Now is an efficient time to revisit your funding technique. The market will at all times be dynamic, however staying adaptable, tuning out short-term noise and focusing in your long-term targets are key. If market fluctuations create alternatives that don’t replicate precise financial fundamentals, traders ought to use them to boost portfolios. Carry on protecting on.