I’ve some excellent news and dangerous information concerning the state of retirement financial savings for People.

Let’s begin with the dangerous information.

Torsten Slok exhibits half of American households haven’t any retirement property to talk of:

Younger individuals nonetheless have time to play catch-up. It’s scary so many individuals 65 and older haven’t any retirement property to lean on. This isn’t nice.

Now for some excellent news from The Wall Road Journal:

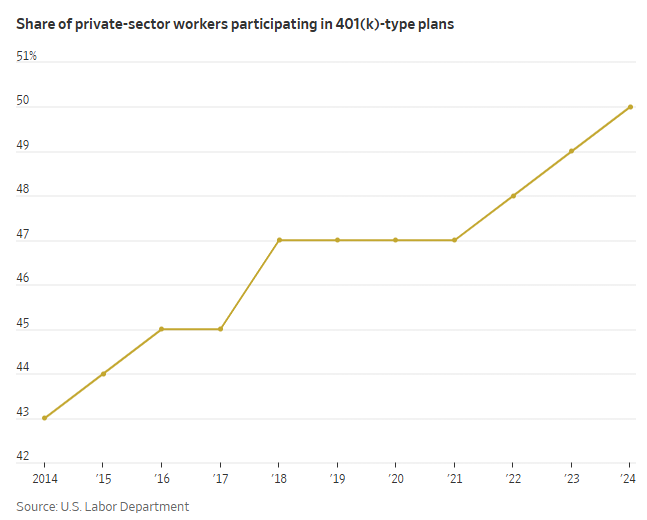

It took practically 50 years, however half of private-sector staff are saving in 401(ok)s for the primary time.

Lengthy after workplaces began utilizing these retirement plans instead of conventional pensions, they’re lastly reaching a tipping level. Round 70% of private-sector staff within the U.S. now have entry to a 401(ok)-style retirement plan. A decade earlier, 60% had entry and 43% contributed, in line with the U.S. Labor Division.

Issues are trending in the suitable course:

Some 70% of personal sector staff now have entry to a office retirement plan, which implies we now have to work on getting that different 20% to enroll. Nonetheless, issues are slowly however absolutely getting higher with extra retirement plans and automated sign-ups.

So is the glass half full or half empty?

These numbers might at all times be higher however I like the truth that an increasing number of individuals are signing up for tax-deferred retirement plans annually.

Clearly, a few of that fifty% who haven’t any retirement property might have a brokerage account, personal a house or have a pension.

Nevertheless it’s additionally true that almost all of this group seemingly depends virtually solely on Social Safety to fund their retirement.

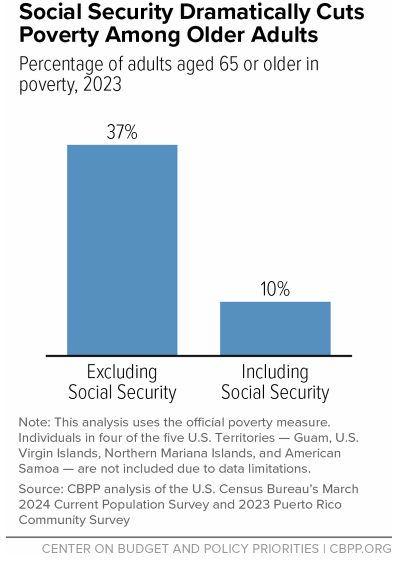

Nearly 40% of adults can be residing in poverty if it weren’t for Social Safety:

This program is at the moment lifting 16.3 million adults out of poverty, or greater than 22 million individuals in whole.

It’s onerous to overstate how vital Social Safety is to thousands and thousands of individuals on this nation.

In need of forcing individuals to avoid wasting for retirement, Social Safety stays the security internet for many who lack entry to retirement autos or don’t have the means to avoid wasting.

Hopefully we now have way more individuals investing in tax-deferred retirement accounts within the years forward.

But when that doesn’t occur, Social Safety will stay an enormous supply of retirement revenue for a big chunk of the inhabitants.

Additional Studying:

Am I Going to Be OK?

This content material, which comprises security-related opinions and/or data, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There could be no ensures or assurances that the views expressed right here might be relevant for any specific information or circumstances, and shouldn’t be relied upon in any method. You must seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “put up” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital property, or efficiency information, are for illustrative functions solely and don’t represent an funding suggestion or provide to offer funding advisory providers. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding resolution. Previous efficiency will not be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from numerous entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or suggest endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the danger of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.