Extreme climate occasions have gotten more and more frequent, and the demand for flood insurance coverage is rising consequently, with insurers having to stability the added danger. GlobalData surveys discover that demand for flood injury to be coated within the US and all over the world may be very excessive, whereas Man Carpenter has warned of the ever- growing danger of flood injury as we head into 2025.

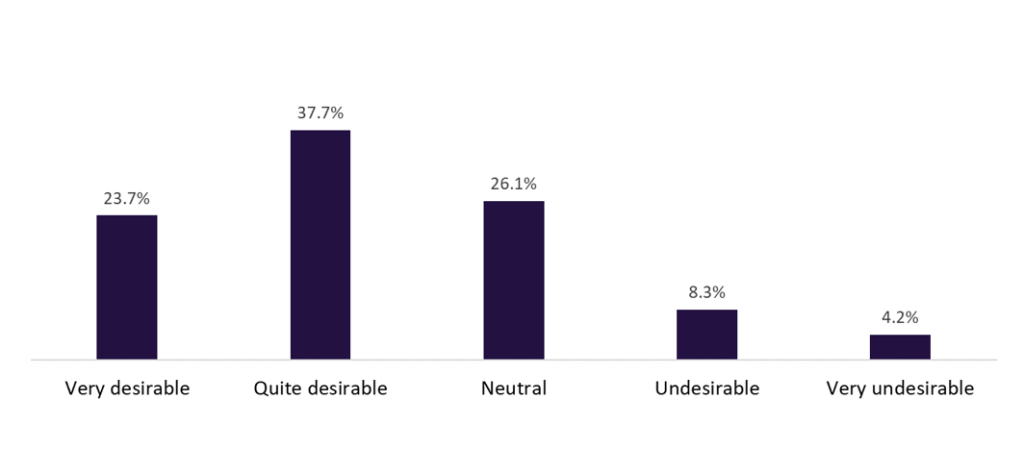

GlobalData’s 2024 Rising Developments in Insurance coverage Survey discovered that 61.4% of US shoppers stated that flood cowl as a part of family insurance coverage was both fascinating or very fascinating. This was barely lower than the mixed international common of 67.0% (boosted by very excessive scores in South Africa [84.4% combined] and China [77.7% combined]). Nonetheless, it nonetheless highlights the robust demand for flood injury to be coated within the US.

How fascinating is canopy for flood injury in private family insurance coverage coverage? The US, 2024

This can be a dilemma that family insurers should weigh up as they create insurance policies. Many areas of the world, and particularly the US, have gotten more and more high-risk and harmful for insurers to supply complete cowl to. They will and can enhance premiums, however inflation stays excessive in lots of international locations—the US being one—and shoppers can’t proceed to be squeezed. Man Carpenter additionally believes that beforehand low-risk areas will turn into extra susceptible to flooding on account of excessive rainfall, which can create extra areas the place insurers will look to restrict publicity.

The numerous demand for flood protection within the US and past signifies that insurers prepared to supply will probably be in a position to enhance retention and penetration charges. For insurers, it’s a case of balancing danger and assessing how a lot potential flood injury publicity they wish to tackle. Insurers trying to capitalize on this could look in direction of preventative measures, akin to ensuring properties are as ready as doable and offering superior climate warnings to prospects.