Business insiders view embedded insurance coverage as having the best development potential within the distribution of private strains insurance coverage over the subsequent 5 years, in response to a GlobalData ballot. Insurers who can navigate the evolving distribution panorama and adapt their distribution methods will likely be finest positioned for fulfillment.

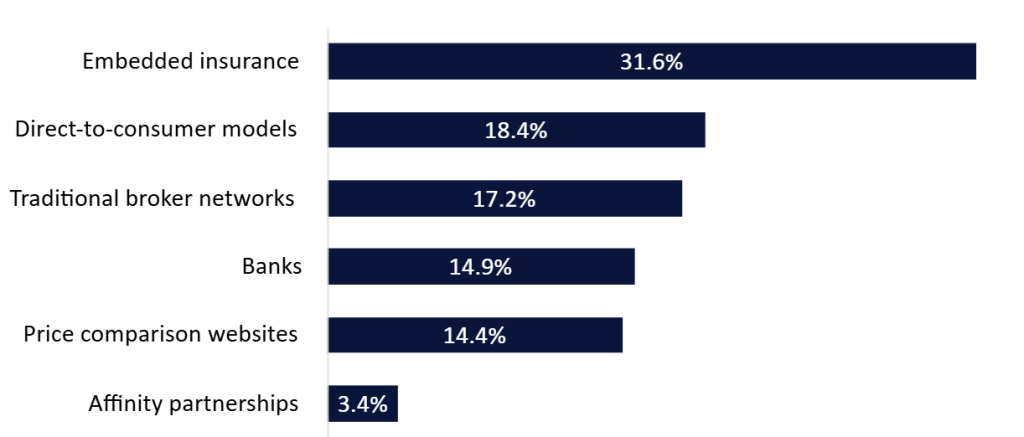

In line with a ballot carried out by GlobalData on Verdict Media websites in Q1 2025, which garnered over 170 responses from trade insiders, embedded insurance coverage is the channel poised for the strongest development within the distribution of private strains insurance coverage, as cited by 31.6% of respondents. The proportion of respondents betting for this channel is considerably larger than for direct-to-consumer fashions (18.4%) or conventional broking networks (17.2%), the opposite most distinguished selections.

Which distribution channel will see probably the most development in individual strains insurance coverage over the subsequent 5 years? 2025

A key aggressive benefit of embedded insurance coverage is that insurance policies are supplied exactly when and the place they’re most related to prospects, growing the probability of a purchase order. Embedded insurance coverage includes integrating insurance policies on the level of sale with a core services or products supplied by a non-insurance enterprise, and the broad nature of firms that may promote insurance coverage magnifies development alternatives. As an illustration, journey insurance coverage may be supplied throughout a flight reserving, motor insurance coverage when promoting a automobile, or gadget insurance coverage with digital items. The truth is, this mannequin permits insurers to achieve prospects who have been in any other case not searching for to take out a coverage.

From a buyer’s perspective, embedded insurance coverage provides comfort and time financial savings, permitting them to take out an insurance coverage coverage concurrently they buy one other good or prepare a service. As well as, insurance policies may additionally be priced extra favorably, as embedding eliminates advertising prices.

Whereas the idea of embedded insurance coverage will not be a brand new one, digital innovation and evolving client expectations have introduced it to gentle. Digital platforms are gaining an increasing number of significance within the embedded insurance coverage mannequin as shoppers proceed to shift away from brick-and-mortar shops in direction of on-line purchases, more and more anticipating frictionless experiences throughout industries.

Though the insurance coverage distribution panorama is changing into extra various and digitally pushed, insurers should nonetheless guarantee presence throughout all distribution channels to cater for the preferences or wants of particular person prospects. Insurers who can efficiently navigate this evolving distribution panorama at a time when client preferences are altering will likely be finest positioned for fulfillment. This can contain adapting their distribution methods and embracing digital innovation to make sure they continue to be related.