In 2024, the Monetary Trade Regulatory Authority elevated the variety of disciplinary actions and the quantity of restitution funds to victims however collected much less in fines, in keeping with an annual evaluation by Eversheds Sutherland LLP.

Eversheds Sutherland’s evaluation, which is carried out by companions Brian Rubin and Adam Pollet, analyzes FINRA’s month-to-month disciplinary releases, press releases and on-line databases to develop a working annual tally of the agency’s actions.

FINRA, because the Washington, D.C.-based regulation agency famous within the report, has been below authorized and political fireplace by monetary corporations and policymakers questioning the constitutionality of its standing as a disciplinary physique within the monetary business. That push made additional noise when the Heritage Basis’s Venture 2025 referred to as for FINRA to be abolished.

Pollet wrote within the report that such a transfer is “extremely unlikely” over the following 4 years, “even when litigants or politicians are profitable in curbing sure practices or having the SEC extra carefully supervised FINRA.”

Eversheds Sutherland additionally forecasted within the report that the variety of enforcement actions by the SEC in opposition to brokers/sellers within the second Trump administration ought to decline, simply as they did within the first. That, nevertheless, could carry enforcement on dealer/sellers by FINRA.

“Given the present political panorama below Trump’s second administration, it’s seemingly we are going to see SEC enforcement slowdown [against broker/dealers], which can current alternatives for FINRA’s enforcement program to extend and fill gaps,” the agency wrote.

Disciplinary Actions

Rubin and Pollet’s 2024 evaluation discovered a soar in disciplinary motion from FINRA year-over-year, rising 23% from 552 disciplinary actions.

In line with the report, the 5 costliest areas of enforcement by FINRA, which is supervised by the Securities and Alternate Fee, had been:

-

Self-discipline for not precisely reporting trades or commerce info, marking the fifth 12 months of main enforcement actions. FINRA referred to as out 21 commerce reporting infractions in 2024, totaling about $9 million in fines.

-

Spoofing instances, through which merchants place an order with the intention of canceling to create the looks of demand they then manipulate for their very own benefit. Whereas there have been solely two such disciplinary actions in 2024, they resulted in about $6 million in fines.

-

Choices buying and selling, which resulted in $4.3 million in fines. A number of the fines got here from corporations failing to detect prospects with money accounts who engaged in “free-riding,” or the shopping for and promoting of securities earlier than paying for them. Different actions got here from corporations not having “fairly designed” methods to handle prospects’ choices buying and selling.

-

Technological points by which a system malfunction or human error led to a failure to adjust to regulatory obligations led to $3.5 million in fines.

-

Self-discipline associated to corporations not appropriately fingerprinting and doing background checks on non-registered staff led to fines of about $2.7 million.

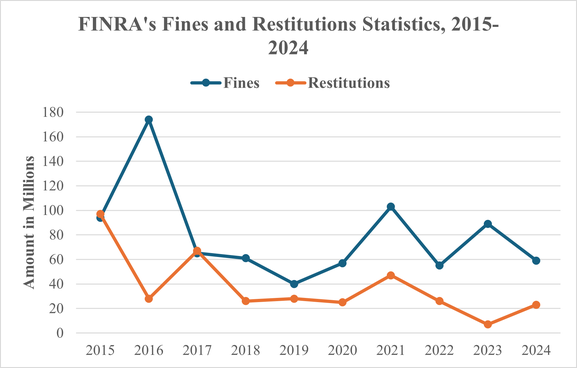

Whereas disciplinary actions had been up from 2023, they mirrored a longer-term decline over the previous decade. Eversheds Sutherland’s monitoring confirmed that FINRA booked over 1,500 disciplinary actions in 2015, with the quantity declining over time.

Restitution

In line with the report, the quantity of restitution paid to victims elevated “considerably” year-over-year.

FINRA ordered restitution funds of about $23 million, up 207% from the $7.5 million in restitution ordered in 2023.

The soar was pushed by FINRA calling for bigger restitution funds of greater than $1 million, together with seven corporations paying fines that totaled about $18 million. In 2023, FINRA ordered just one agency to pay a restitution of $1 million.

Fines

Whereas restitution funds had been up, complete fines to FINRA fell to $59 million from $89 million year-over-year.

The regulation agency famous that FINRA had one massive fantastic of $24 million in 2023, partly driving that increased determine.