To rejoice Ladies’s World Banking’s forty fifth anniversary, we’re showcasing voices from all over the world who’ve formed our journey since 1979—from the Fee on the Standing of Ladies to at the moment. These tales replicate the impression of Ladies’s World Banking throughout the ladies we serve, our prospects, and the allies driving monetary inclusion ahead.

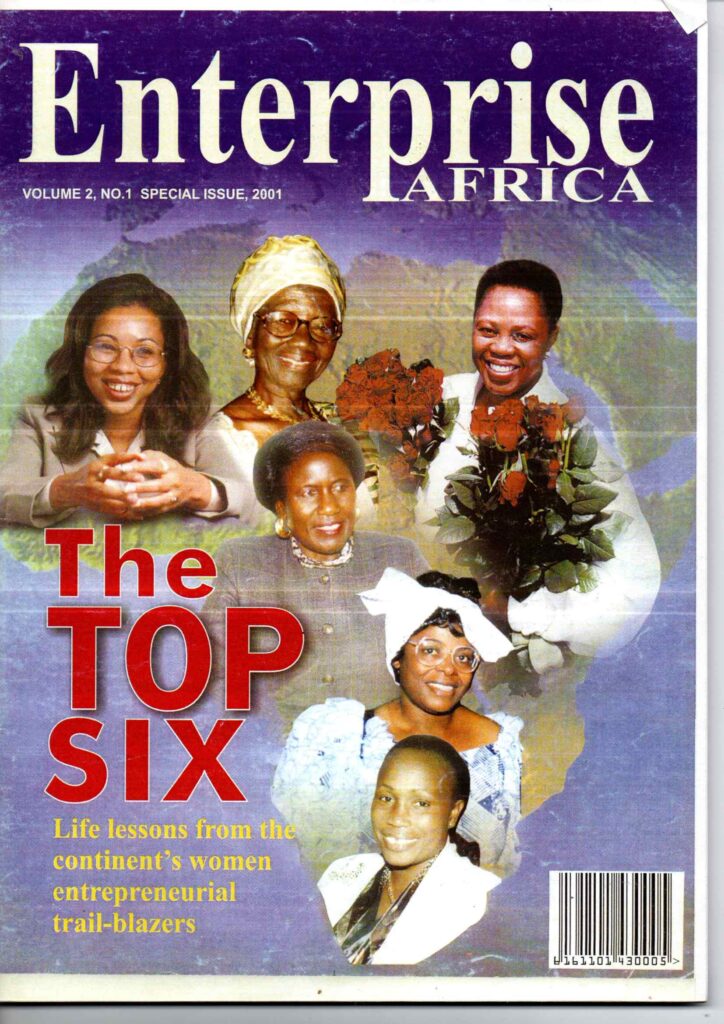

Celebrating Mary’s Legacy: An Explorer for Monetary Empowerment in Africa

Dr. Mary Okelo’s title stands as a pillar of power and inspiration within the historical past of Ladies’s World Banking (WWB). Her contributions laid the inspiration for breaking systemic boundaries that excluded girls from financial participation, remodeling the panorama for generations to return. Via her journey, we see not solely the transformative energy of management but additionally the profound impression of braveness, willpower, and imaginative and prescient.

Fairness and Compassion

Mary’s journey started with the values instilled in her by her dad and mom. “In my upbringing, my dad and mom gave equal alternatives to each girls and boys. We had no discrimination,” Mary shares. Her dad and mom cared for folks with disabilities and the marginalized, empowering them to steer significant lives. “This background instilled in me the motivation to share what I’ve with others, serving to them to reside their objective,” she provides.

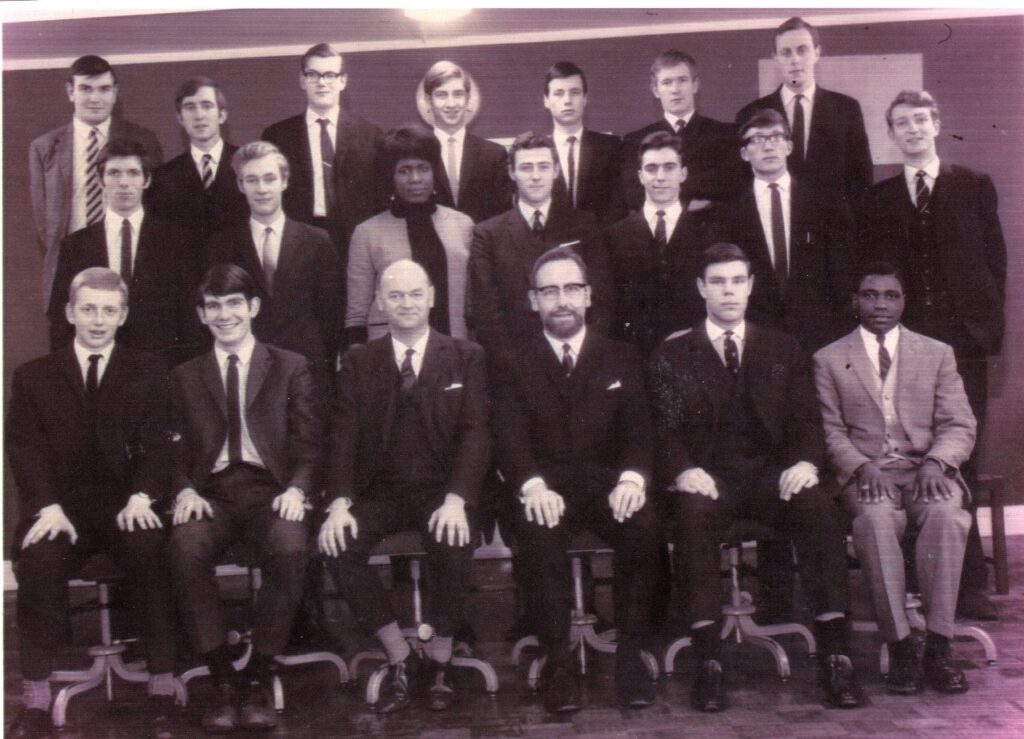

Her schooling additional bolstered these values. As considered one of solely 13 ladies chosen within the nation to pursue Cambridge Superior Ranges, Mary felt the burden of duty. “We have been informed if we failed, different ladies wouldn’t have a chance to do A-Degree. This gave me the will to help others. We supported one another, and all of us succeeded. I discovered that if a girl succeeds, it motivates different girls to succeed,” she explains.

This spirit of Ubuntu, the African philosophy of collective well-being, additionally grew to become a cornerstone of Mary’s method to management and group constructing. “I’m an African raised within the spirit of Ubuntu, which reminds us to take care of others—‘that I’m who I’m due to who all of us are.’ While you see a barrier, you take away it in order that these following you’ve gotten simpler entry,” she says.

Founding Kenya Ladies Finance Belief

In 1981, Mary co-founded the Kenya Ladies Finance Belief (KWFT) as an affiliate of WWB, sharing its mission of empowering girls economically. “We began KWFT to empower girls financially so they might take part equally in society and the financial system,” Mary remembers.

At a time when monetary methods excluded girls, KWFT confronted monumental challenges. “Banks and monetary establishments have been unwilling to take the danger of extending monetary companies to girls,” she says. However her resilience and resourcefulness prevailed. Mary approached each financial institution within the nation, however solely Barclays, by way of its Managing Director TD Miles, was prepared to supply a assure. She mobilized 100 girls as founder members to lift preliminary capital, however the lack of economic literacy amongst girls added to the difficulties. “Ladies weren’t conversant in monetary language and operations. They required lots of coaching, which was costly and time-consuming,” Mary explains.

Regardless of these hurdles, KWFT not solely broke down systemic boundaries but additionally demonstrated that ladies have been bankable. “Ladies proved to banks that they might repay loans and handle funds, paving the way in which for banks to simply accept them and create particular merchandise focusing on them,” she says.

Breaking Gender Norms in a Male-Dominated Business

As the primary feminine financial institution supervisor in East Africa, Mary confronted important societal and institutional resistance.

“Male purchasers would stroll into my workplace and ask, ‘The place is the supervisor?’ They weren’t used to discussing monetary points with girls. Some handled me as a sister, mom, or girlfriend, nevertheless it all the time took time to interrupt that barrier,” Mary recounts.

Institutional challenges have been equally daunting. “The primary Barclays department I used to be despatched to had no girls’ bathroom. I used to be proven a door, and after I received in, I noticed male standing urinals, which I used to be unable to make use of,” she remembers. But, Mary’s resilience and flexibility shone by way of, inspiring girls to enter management roles in banking.

Her advocacy prolonged to defending girls within the office. “If a girl grew to become pregnant and was threatened with dismissal, I needed to defend her. I additionally needed to sensitize girls about resisting sexual favors and struggle sexual harassment,” she says. Her efforts laid the groundwork for higher gender fairness within the banking sector, breaking boundaries and setting a precedent for future generations of ladies leaders.

Because the founding father of the Barclays Financial institution Ladies’s Affiliation, she mentored numerous younger girls. “The mentoring program enabled them to develop professionally and rise to management positions. At one time, Barclays had the best variety of girls in managerial positions within the nation,” she shares proudly.

Reminiscences with Ladies’s World Banking

Mary’s fond recollections with Ladies’s World Banking are as wealthy and impactful as her achievements. One in all her most cherished recollections was her partnership with Michaela Walsh, the visionary founding father of Ladies’s World Banking. “Assembly and dealing with Michaela Walsh modified my life,” Mary shares. “Her braveness and dedication impressed me. When she appointed me as Africa Regional Consultant, it gave me publicity and opened many doorways for me.”

Beneath her stewardship, Ladies’s World Banking established associates in Uganda, Senegal, and Zambia, amongst different nations. Her advocacy additionally influenced broader coverage adjustments. “On the coverage stage, the elimination of all discriminatory legal guidelines in opposition to girls and the adoption of the Ladies in Improvement coverage paper by the African Improvement Financial institution have been large achievements,” she says. From empowering girls to show their bankability to influencing banks to develop merchandise particularly tailor-made for ladies, her work helped take away systemic boundaries and create alternatives for ladies to thrive economically.

A Name for Continued Progress

Whereas Mary celebrates the progress made in girls’s monetary inclusion, she emphasizes that a lot work stays. “Ladies are nonetheless primarily in microfinance, and it’s time they graduated to macro-finance. Extra coaching, mentoring, and sharing of knowledge past micro is important,” she urges.

Mary’s legacy with Ladies’s World Banking and her work in Africa proceed to encourage generations of ladies to interrupt boundaries, create alternatives, and lead with objective.

Discover the inspiring tales of different Ladies’s World Banking founding members like Michaela Walsh, Ela Bhatt, and Esther Ocloo and study extra about WWB’s ongoing work in Africa.

Ladies’s World Banking stays dedicated to financial empowerment by way of monetary inclusion for practically one billion girls who lack entry to formal monetary companies. Our method—rooted in market analysis and advocacy—interprets insights into actual motion, from digital monetary options to gender lens investing and office management packages.

As a part of our technique, we’ve already helped 86 million girls in rising markets entry monetary merchandise that rework their lives. We’re on monitor to succeed in 100 million by 2027, driving inclusive development globally.

Let’s shut the monetary hole. Be part of us in reaching the practically billion girls nonetheless excluded from the formal monetary system. Donate at the moment.